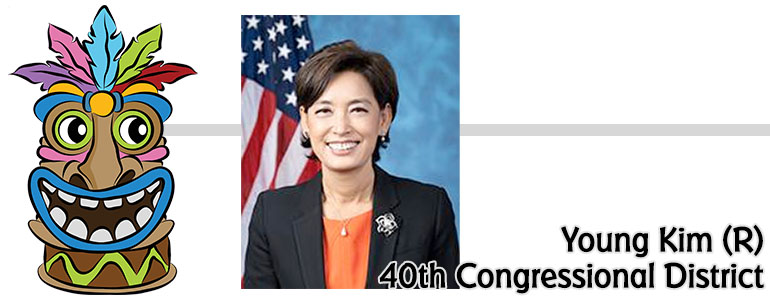

U.S. Representative Young Kim (CA-40) voted in support of the Family and Small Business Taxpayer Protection Act (H.R. 23) to rescind over $70 billion in Internal Revenue Service (IRS) funding added last year through the Inflation Reduction Act.

According to the Congressional Budget Office (CBO), the $80 billion in IRS funding on top of a $12 billion annual IRS budget will cause audit rates to “rise for all taxpayers,” and a conservative analysis shows that returning audit rates to 2010 levels would mean 1.2 million more audits with over 700,000 of those falling on taxpayers making $75,000 or less.

Nonpartisan analysis from the Joint Committee on Taxation showed that the Inflation Reduction Act would increase tax revenue by $16.7 billion from Americans earning less than $200,000 a year, and tax revenue collected from those making $100,000 per year or less would increase by $5.8 billion.

The Family and Small Business Taxpayer Protection Act would rescind more than $70 billion in new IRS funding to prevent the agency from conducting additional audits on American families and small businesses and leave in place funding for customer service and IT upgrades to improve IRS efficiency for Americans.

“Americans are burdened enough by high taxes and regulations. Adding 87,000 more IRS agents and requiring more paperwork for Venmo payments only adds fuel to the regulatory fire,” said Rep. Kim. “I voted for the Family and Small Business Taxpayer Protection Act to eliminate this unnecessary funding, prevent the IRS from squeezing middle-class families and small businesses, and enhance the services Americans expect to receive from their government. I will always work hard to make life easier and more affordable for California’s 40th District.”