Every election, the Sun asks Seal Beach candidates questions and publishes their answers.

The following are their answers. The candidates answered the questions by our deadline of Monday, Oct. 7. The Sun emailed the 2024 questions to the candidates on Friday, Sept. 27.

Readers should know that each of the candidates for District Two and District Four are running unopposed.

The answers were only edited for spelling and word length. The maximum word limit was 200 words per answer. No one exceeded the word limit.

District Two

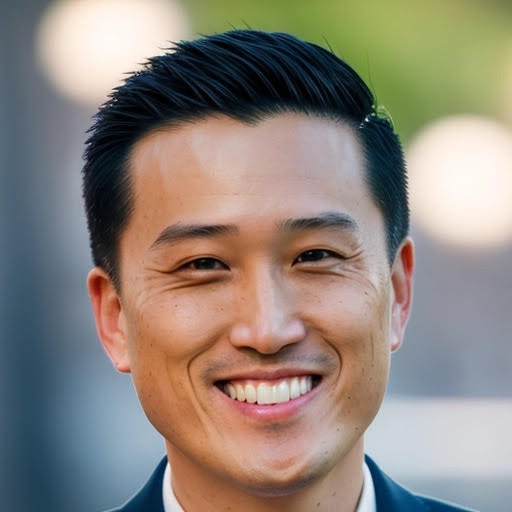

Ben Wong

1. Introduce yourself.

Seal Beach is my home.

I humbly ask for the honor to represent this city to continue the fight to protect and uplift this community that we all share and love.

My name is Ben Wong. As a devoted husband to my wife now of 12 years, we initially moved to Seal Beach in 2013 where our 9-year-old son was born and raised.

I originally grew up in Huntington Beach and graduated from UC Irvine. My work experience includes audit, corporate accounting, and I currently serve as Assistant Controller for a publicly traded company.

I highly value public safety, a well-balanced budget, supporting local business, as well as seeking to better shield our senior citizens from the rising cost of living.

Law enforcement will continue to have my firm support in treating shoplifting as a crime.

A long-term solution to the current budget deficit must include better promotion of business and avoid placing an even greater tax burden upon families and retirees.

Prior to my current position as Planning Commissioner, I previously served on the Environmental Quality Control Board for 7-years.

I would be honored with your vote to better serve Seal Beach: the place we all know as home.

2. Do you support or oppose Measure GG, the Seal Beach half-cent sales tax? What is the reason for your position and briefly describe where do you think the money would be best invested. If it fails, what strategy do you think the city needs to compensate?

Raising the sales tax is never a long-term solution.

To be direct, I see raising the sales tax as a stop gap until it is asked to be raised again.

A 1% sales tax increase already took effect under Measure BB from 7.75% to 8.75% starting in 2019.

Measure GG will bring us to a new tax rate of 9.25% or nearly a 20% increase within a 5-year span.

Moreover, I view a sales tax hike as regressive, meaning that it takes a larger percentage of income from those who can least afford it.

If we’re concerned about inflation, then raising our sales tax will only add to the problem.

If Measure GG does pass, and instead of the sales tax increase flowing into the general fund, there should be a commitment towards 1) a pension pay-down plan to improve the city’s fiscal health, 2) a financial plan that includes freezing positions if we’re running at a negative balance, and 3) funding capital infrastructure projects.

Will a ½ cent sales tax for every dollar spent deter us from spending? No, it will not.

Yet, I plan to vote “no” and I hope you will too.

3. Do you think the city’s financial position makes it necessary to reassess spending and where to you believe budget cuts can be made?

Yes, we’re currently running at not only a budget deficit, but a structural deficit. This means that our spending is projected to outpace our revenue beyond just 1-year and instead for the long-term.

I will be direct and write that I do not know where budget cuts can be made at this time without knowing the full scope of the city’s current financial position.

I do believe the city is doing its best, but sometimes it may take a fresh new set of eyes to reassess where changes can be made.

4. Besides raising taxes, how else do you think the city can enhance its revenue? For example: encourage tourism? Increase development? What policy would you support to make it happen?

The long-term solution to a fiscally healthy Seal Beach is to encourage both tourism and the establishment of new businesses. I would like to revisit the pier to see if “pop-up” food stands can be established to draw new visitors. The city has proposed the idea of establishing new billboard signs along major driving corridors to draw in new marketing revenue, which I support as a new and creative revenue source.

5. What is your top requirement for a new city manager, and what criteria will you use to judge their future success?

I would like the new city manager to be fiscally responsible while maintaining public safety and services. I understand this is neither a simple nor easy request. Yet, I would like to work “hand-in-hand” to support the new city manager and city staff to accomplish this goal. This is how I would view success for both the city manager and the city itself.

Thank you for your time in hearing some of my thoughts.

District Four

Patty Senecal

1. Introduce yourself.

I have thirty seven years of business experience in the private sector. My background is in business development, business administration, government and public affairs. I began my career in the freight logistics industry specializing in trucking and warehousing services for import and export clients, utilizing the Ports of Long Beach and Los Angeles. Currently, I work in the energy sector for a trade association. I am also a member of the Seal Beach Lions and Seal Beach Chamber Board of Directors. I was appointed to the Seal Beach Citizen-Council Stormwater Advisory Ad-Hoc in 2024. My family and I have been blessed to live in wonderful College Park East for fifteen years. www.senecal4sealcom

2. Do you support or oppose Measure GG, the Seal Beach half-cent sales tax? What is the reason for your position and briefly describe where do you think the money would be best invested. If it fails, what strategy do you think the city needs to compensate?

I support the right of the residents to vote up or down the half-cent tax increase. If approved by the voters, the new sales tax rate would be 9.25% with a projected income of $3M. This new tax rate would place Seal Beach among Orange County cities with the highest sales tax. Staff presentations note 50% of the current sales tax dollars collected are paid by tourist and day visitors. If passed, per the ballot description, the increased funds are dedicated to the general fund to maintain current service levels (public safety, keeping beaches and public areas clean/safe, addressing homelessness, street repairs, water quality and reduce flooding). Staff is not proposing to add additional services. Like all cities, we are suffering from higher inflationary cost for goods and services. Whether GG is passed or not, you can count on me to work with our City Manager and City Council colleagues when we start budget discussion in February 2025. A big priority for me is to plan for our aging infrastructure upgrades and to reduce city wide flood risks.

3. Do you think the city’s financial position makes it necessary to reassess spending and where do you believe budget cuts can be made?

In good and bad times, our city should continually reassess how taxpayer funds are spent for residents, visitors and business services. I am eager to learn how our Staff is proposing to maintain services with our projected budget shortfalls over the next five years. I take the council seat in January 2025. Then I can offer more commentary as we work though our upcoming budget cycle.

4. Besides raising taxes, how else do you think the city can enhance its revenue? For example: encourage tourism? Increase development? What policy would you support to make it happen?

The charm of Seal Beach City is the natural beauty, amazing sunsets, surf culture, clean and safe beaches, and the family oriented nature of a small town. The challenge is to preserve our hometown atmosphere and quality of life, while balancing economic opportunities to increase city revenue. As a small city, we don’t have an economic development staff position. Thus, the collective ideas of our City Manager and team, City Council, businesses community and residents will be important on how to increase revenue. I will be reaching out to our residents to generate workable ideas and solutions. I would like to explore how we can draw visitors to our shopping/entertainment districts with 2028 Olympics in our area. As a built out coastal city, new development will be incredibly challenging.

5. What is your top requirement for a new city manager, and what criteria will you use to judge their future success?

The top requirement is to be able to plan, organize, budget, and manage the city activities at the direction of the elected City Council. Budgeting and revenue growth will be a key criteria to judge our collective success. The success of the City Manager will be judged by addressing the concerns of our residents, balancing the budget, maintaining public safety, planning for aging infrastructure and working collaboratively with the City Council members for transparency and stewardship of our charming city.